新用户登录后自动创建账号

登录海航集团收购Dufry16.79%股份!

收购背景介绍

据报道,中国航空休闲巨头海航集团于今年3月与Dufry主权财富基金股东GIC以及新加坡基金淡马锡谈论了关于投资世界最大旅游零售公司的问题。

投资界可靠消息向The Moodie Davitt Report确认了这个消息。华尔街日报在这周也报道了相关消息。 两个新加坡基金总共持有Dufry超过16%的股份。

据报道,海航集团达到3%的股份时必须做一个公开披露。然而瑞士收购规则称必要的披露只需等到持股高达33.01%后才进行。

直到现在Dufry也没有收到来自HNA的消息,导致了投资界不确定这个中国集团的收购意图。考虑到Dufry的股权结构和中国海外投资限制,恶意收购是十分难以实现的,而且从海航的交易历史看这几乎是不可能的。

最初来源认为,最有可能的情况是海航集团想通过增加对世界上最大的旅游零售公司的影响来寻求扩大其在旅游服务链的地位。(It already owns gategroup; Carlson Hotels; a 25% stake in Hilton Worldwide Holdings; CIT Group’s aircraft leasing business; 13% of Virgin Australia; 23.7% of Azul Brazilian Airlines; and airport luggage handler Swissport International)

这样的立场对其额外的好处是它是其他集团在未来更加控制Dufry。随着今天的爆炸性新闻,那个“怪兽”现在出现了。

Dufry集团简介

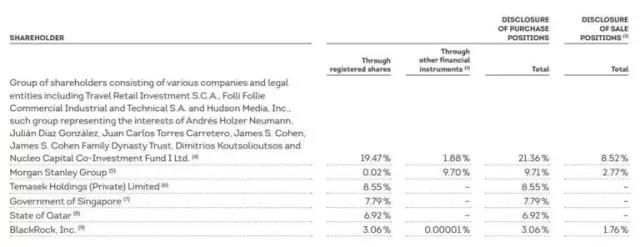

List of Dufry shareholders, taken from its Annual Report 2016

HNA Group’s stake gives the ambitious Chinese aviation-to-leisure services giant a position of major influence in the world’s largest travel retailer;

Source: The Moodie Davitt Report

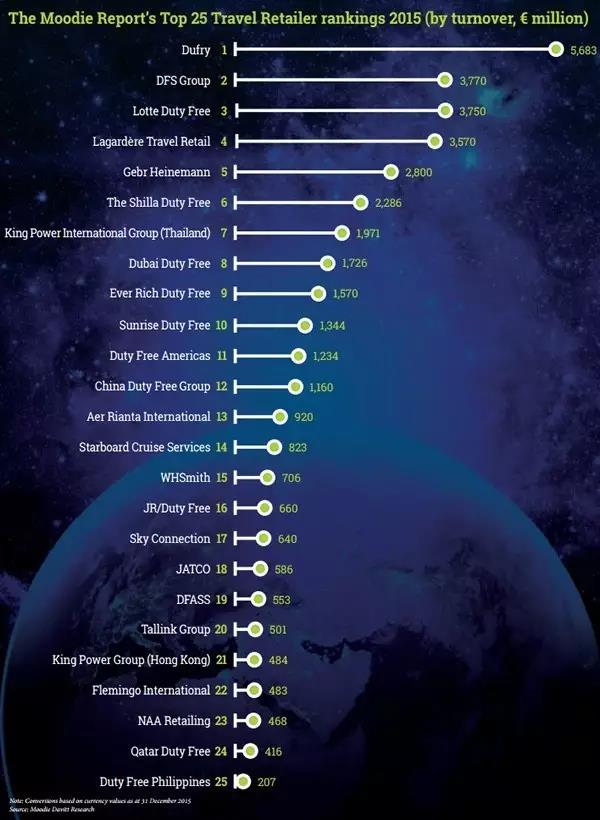

作为世界旅游零售业领导者,Dufry有限公司于1865年成立,其总部位于Basel, Switzerland,并在瑞士和巴西公开上市。Dufry在机场、邮轮、海港、火车站和城市旅游景点拥有大约2200家免税店,雇佣了近29000位员工。

Dufry是唯一一个直接在世界5大洲64个国家运营的旅游零售公司,其联盟和收购使得Dufry这个行业领头羊能为顾客和品牌提供无可比拟的产业网。其国际化程度也使其拥有丰富的见解和专业知识,并能运用于本土市场管理当中。

据投资行业研究显示,世界第一大免税集团的Dufry集团,它的由小到大,是经历了一段为期十年的兼并收购,横向扩张、销售额迅速做大的过程。随着销售额扩大,Dufry集团免税业务毛利率由2004年的50.6%,上升到2016年的70.7%(DFE:似乎有点高啊!)

From The Moodie Davitt Report May Print Edition,

out in coming days

I’m not normally one for predictions but I’ll make one here. The acquisitive, Hainan-based conglomerate HNA Group has pulled off a flurry of major acquisitions in recent times and I believe travel retail will be among its next power plays.

Don’t forget either that at its 28 October 2016 board meeting, CDFG parent China International Travel Service voted to create a joint venture with Hainan Duty Free. And Hainan Duty Free (full name HNDF Haikou Meilan Airport Duty Free Shop) is a provincial government and private partnership between Hainan Provincial Duty Free Company Limited and none other than HNA Group. Just think of the possible permutations among that network of relationships.

“Piecing together a jigsaw puzzle”

When it reported HNA Group’s US$6.5 billion bid for a 25% stake in the Hilton hotel chain last October, the Financial Times (FT) said the deal “cemented its reputation as one of China’s most acquisitive groups”.

In under two years the privately controlled company had announced foreign and domestic transactions worth over US$33 billion (see acquisition trail above), the FT noted — half spent offshore, according to data provider Dealogic — as it forged a global empire with interests spanning aviation, logistics and tourism.

The FT commented: “Begun in 1989 as a private airline on the tropical island of Hainan, HNA’s buying spree shows no sign of slowing. Founder Chen Feng, a former employee of China’s state civil aviation administration, has transformed Hainan Airlines, the group’s flagship company, from a two-jet operation into the country’s fourth-largest airline and has built a sprawling conglomerate.

“While Mr Chen has largely ceded control of the group’s day-to-day operations to his co-chairman, Wang Jian, and chief executive Adam Tan, the Hilton acquisition is a key piece of his plan to profit from Chinese tourists as they travel around the world.”

The FI cited a source close to HNA saying, “The vision is to be a vertically integrated aviation and tourist group. They are buying different pieces and putting it together like a jigsaw puzzle.”

Not only is HNA acquiring a large piece of Dufry but also, it appearsa, another key piece of that puzzle.

*本文来源:Moodie Davitt,原标题:《【重磅】海航集团收购Dufry16.79%股份!》

【号外】想要捕捉文旅大消费行业风向标?想要了解最前沿的文旅跨界创新?想要学习行业大佬最新的干货分享?想要与行业精英现场互动深入交流?来“2017中国文旅大消费创新峰会”吧!6月13-14日,北京·国际会议中心,文旅大消费顶级内容盛宴等你来!了解会议详情&报名请戳:我要报名!(提前报名有优惠)

.jpg)